Helping you take Governance, Risk & Compliance to the next level

Building proactive governance, risk and compliance capabilities for resilience and agility.

Deep Expertise with Institutional Investors:

We bring decades of specialized experience serving public retirement systems, investment boards, sovereign wealth funds, and other institutional investors, navigating their unique governance, fiduciary, and compliance challenges.

Thought Leadership and Tools:

We have developed powerful; and innovative governance frameworks, practical tools, and insightful analyses that empower institutional leaders to effectively manage and oversee risk, compliance, and strategic decision-making.

Practical Advice:

Our recommendations are actionable, pragmatic, and tailored specifically to the realities of each client, to achieve tangible improvements and measurable outcomes.

Trusted Advisors:

Clients rely on our integrity, independence, and objectivity, making us their go-to partner for critical governance and fiduciary decisions.

Committed to Client Success – One Size Fits One!:

Every client receives personalized attention and bespoke solutions, recognizing that each organization's challenges, culture, and objectives are unique.

Our Areas of Expertise Include:

Governance, Risk & Compliance

Peer Benchmarking

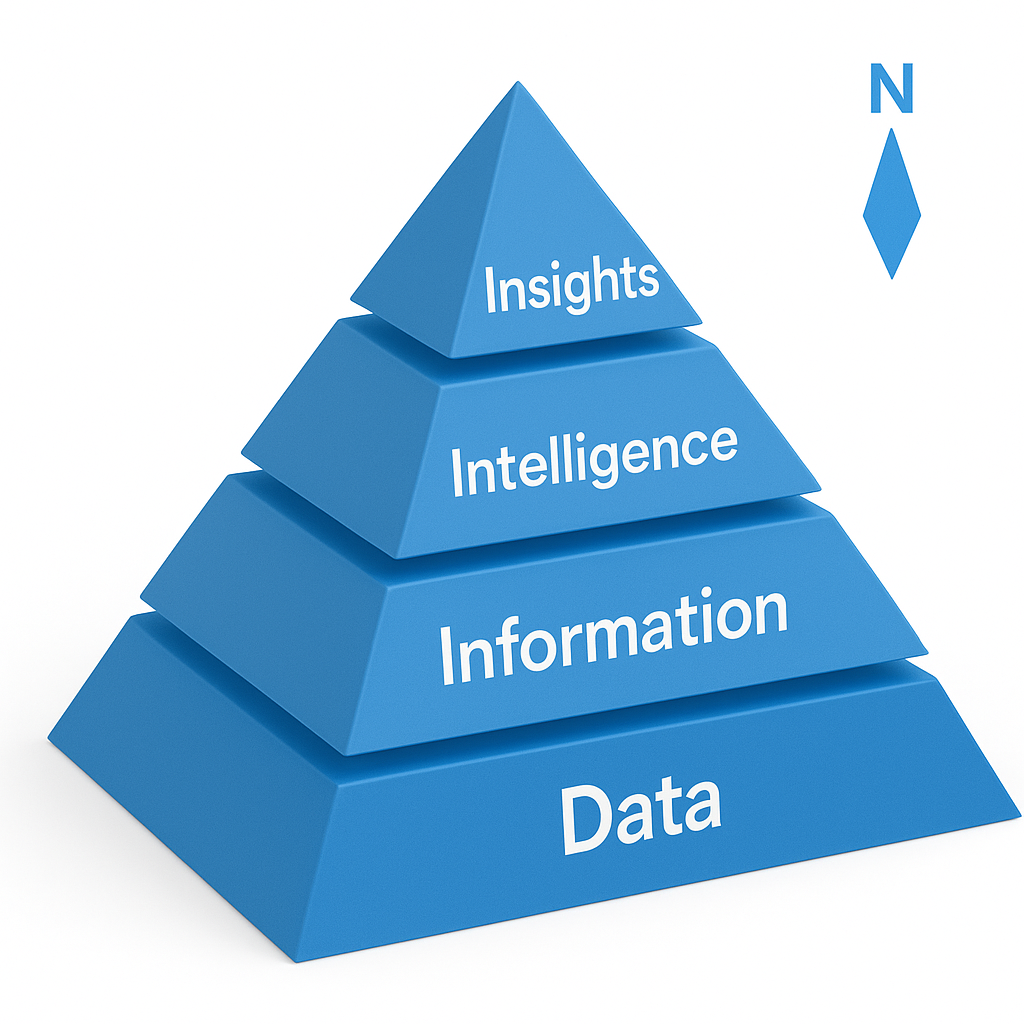

Enterprise Risk Management and Risk Intelligence

Leadership Development & Coaching

Facilitation

Testimonials

-

“FAS has a talented and professional team with a deep and practical understanding of how a highly effective pension fund investment organization needs to be governed and operate.”

CEO State Investment Board

-

"Each of FAS' fiduciary performance audits included an assessment of the respective retirement boards' governance. FAS' approach was clearly not a "check the boxes" routine. They approached each board individually to assess the needs, statutory authority, and functionality of the board and then compared those areas to best practices. The systems have implemented the majority of suggestions from FAS.”

State Oversight Body

-

“Funston’s services have been of invaluable and of significant benefit to the system, its governing Boad and the members.”

Executive Director, State Retirement System

Our Services

Governance, Risk & Compliance Reviews

Charters

Policies

Procedures and Practices

Board Meeting Materials

Compliance, Risk, and Control

Peer Benchmarking

InGov - Governance Benchmarking

GEM - Governance Effectiveness Management

N3PR - National Public Pension Policy Repository

MGPM - Model Governance Policy Manual

Proprietary Tools and Knowledge Bases

Program Capability Maturity Assessment

Exception-Based Reporting

Governance, Risk and Compliance Surveys

Enterprise Risk Management and Risk Intelligence

Leadership Development & Coaching

In-person and online governance and fiduciary training (Board Smart)

Onboarding

Continuing Education

Leadership Coaching

Board & Executive

Expert Facilitation

Board Retreats

Board Self-Evaluation

CEO/ED Evaluation

Strategic Planning

Conflict Resolution

Contact Us

Address:

3838 Tamiami Trail N., Suite 416

Naples, FL 34103

Rick Funston: +1 (313) 919-3014

Rfunston@Funstonadv.Com

Evan Norton: (647) 282-7454

enorton@funstonadv.com